|

| source: Federal Reserve Bank of St. Louis |

In my memory, 1974 was not a particularly happy year.

President Nixon resigned in August 1974 in the aftermath of the Watergate scandal. He left behind a country that was about to see its decades-long military effort in Vietnam collapse. Inflationary pressures were continuing to build, pushing prices ever higher. The mood of the country was sour.

Yet an article published over last weekend contended that 1974 was actually a year that U.S. workers should celebrate.

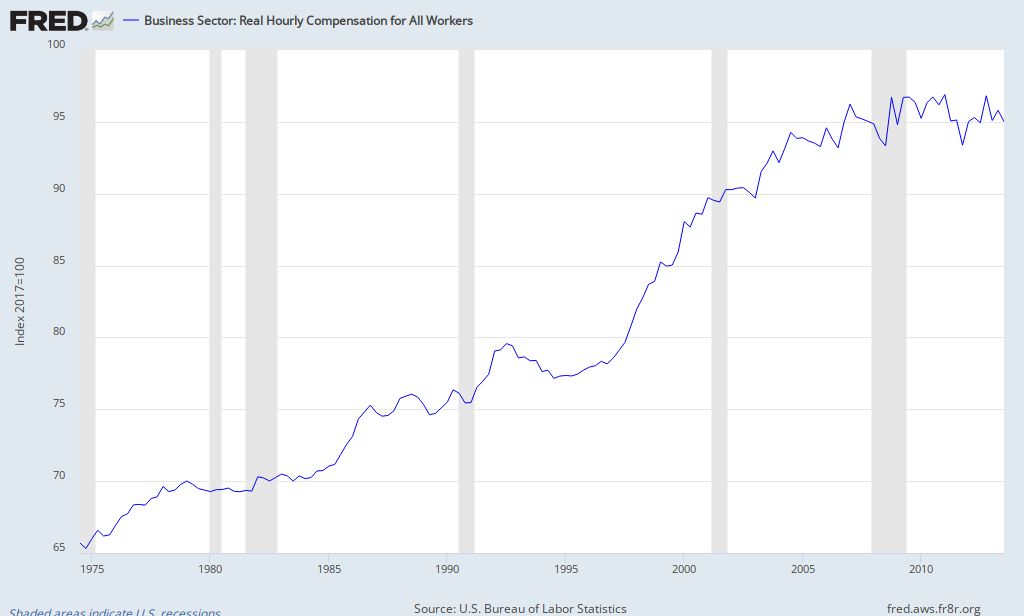

Harold Myerson wrote a long article for American Prospect that pointed out that 1974 marked the end of a long-term trend that had started after World War II which had seen a steady rise in middle class wages and living standards.

The upper income class had not benefited to the same degree as the middle class, which meant that the wage differential between the higher paid and lower paid workers had narrowed considerably:

Since 1947, Americans at all points on the economic spectrum had become a little better off with each passing year. The economy’s rising tide, as President John F. Kennedy had famously said, was lifting all boats. Productivity had risen by 97 percent in the preceding quarter-century, and median wages had risen by 95 percent. As economist John Kenneth Galbraith noted in The Affluent Society, this newly middle-class nation had become more egalitarian. ...Economists have dubbed the period the “Great Compression.”

However, as Myerson writes, 1974 marked the end of the improvement in real wage gains for most Americans. For the next 40 years, wage and wealth gaps would widen enormously:

Then, it all stopped. In 1974, wages fell by 2.1 percent and median household income shrunk by $1,500. To be sure, it was a year of mild recession, but the nation had experienced five previous downturns during its 25-year run of prosperity without seeing wages come down.

What no one grasped at the time was that this wasn’t a one-year anomaly, that 1974 would mark a fundamental breakpoint in American economic history. In the years since, the tide has continued to rise, but a growing number of boats have been chained to the bottom. Productivity has increased by 80 percent, but median compensation (that’s wages plus benefits) has risen by just 11 percent during that time. The middle-income jobs of the nation’s postwar boom years have disproportionately vanished. Low-wage jobs have disproportionately burgeoned. Employment has become less secure. Benefits have been cut. The dictionary definition of “layoff” has changed, from denoting a temporary severance from one’s job to denoting a permanent severance.

http://prospect.org/article/40-year-slump#.UpnnWfSn9h4.twitter

In other words, the "Great Compression" of the post-war period has turned into the "Great Expansion". Wage and wealth gains have been largely concentrated in the upper income category, while most workers have not participated.

In a fairly heartless fashion, the stock market has apparently taken note of the lack of wage growth and moved steadily higher. Investors are cheered by the fact that while top line growth has been meager, margins have remained at record highs, allowing for profits to continue growing.

Here's what Bloomberg reported this morning:

The weakest employment recovery in seven decades is proving a boon to equity markets.

Five years into a rally that has restored $14 trillion to share prices, U.S. payrolls remain 1.5 million below the level in 2008, according to data compiled by Bloomberg. Resistance to hiring from ConocoPhillips to Walt Disney Co. (DIS) will help push Standard & Poor’s 500 Index profit margins above 10 percent next year, the highest ever, data show. Below-average employment was cited last month by Federal Reserve chairman nominee Janet Yellen as the biggest obstacle to raising interest rates.

While American workers struggle, investors are benefiting as expense reductions and record low borrowing costs drive profits and underpin a 167 percent advance in the S&P 500 over the past 57 months. To bulls...{this means that} equities will keep rallying as long as the Fed remains more concerned about employment than inflation.

http://www.bloomberg.com/news/2013-12-02/bull-market-shows-no-sign-of-death-with-yellen-support.html

No comments:

Post a Comment