|

| courtesy: @tradefast |

One of the more common topics in recent client meetings is whether the equity markets are due for a major correction after the elections.

Or, put another way, should equity weightings be reduced, or at the very least new purchases deferred, until the "dust clears" after the elections next week.

Work done by Ned Davis Research indicates that historically, going back to 1900, markets typically rally after Presidential elections.

The type of rally differs based on which candidate wins.

If the incumbent wins, stocks historically have moved sharply higher, presumably since there is less uncertainty with regards to government policies in the coming years.

If the challenger wins, markets historically have sold off right after the elections, but then rally into the year-end once the new administration starts to take shape.

In either case, however, stocks tend to rally into the end of year.

I found the data in the chart above to be useful in framing the investment decision. No one wants to buy "at the top", and since stocks have rallied nicely over the past 12 months clients are understandably concerned whether they wouldn't be better served by moving to the sidelines for the time being.

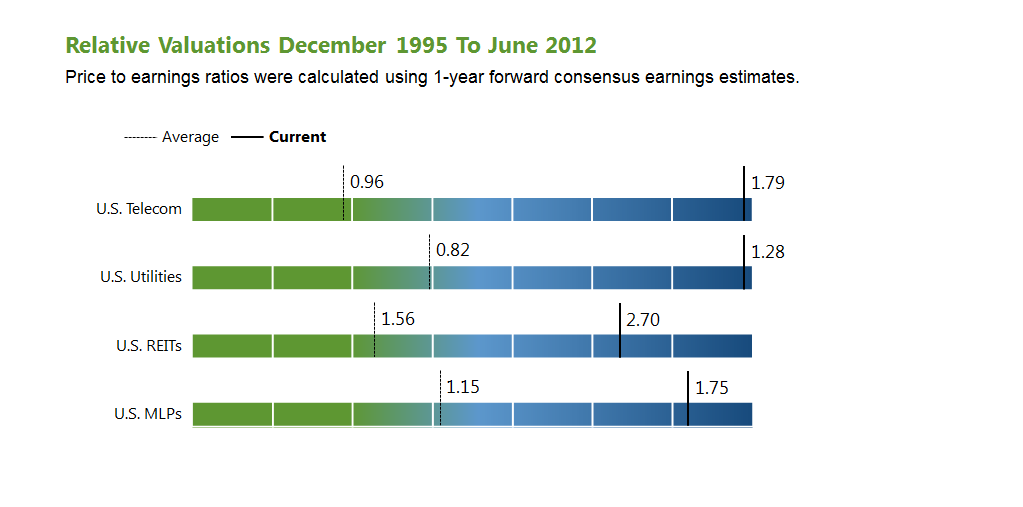

However, as you hopefully can see above, surveying the investment landscape with the S&P now nearing levels last reached in 2000 and 2007 reveals a number of important differences from prior years.

Most importantly, in my opinion, is valuation. Even with a shaky economic environment, and corporate chieftains sounding a cautious note on the outlook ahead, stocks today are trading at less than 13x (forward) earnings. P/E ratios were double today's level 12 years ago, when everyone it seemed wanted to be a buyer of stocks.

Earnings have continued to grow for Corporate America, but the nervous tone of the market is rewarding results less enthusiastically.

Then there is the comparison of stocks with the alternatives - a familiar topic to regular readers of Random Glenings.

Dividend yields today are also double the level of 12 years ago. With corporate America sitting on $1.6 trillion of cash reserves, there is significant potential for dividend increases in the years ahead. Indeed, several corporations are openly discussing the possibility of a special year-end dividend in anticipation of higher dividend tax rates in 2013.

Dividend yields are also higher than bond yields. The last time this occurred was in the 1950's. While it is true that stocks can be more volatile than bonds, for income-oriented investors with a longer term time horizon will find plenty of opportunity in today's stock markets.

Finally, there is this: S&P earnings for 2012 are now forecast to be around $105. If earnings grow at a modest +5% per year for the next couple of years, the stocks in the S&P will earn around $116. Applying a 14x multiple to this earnings gives an ending S&P value of around 1620 by the end of 2014. This would mean that, including the 2% per annum dividend yield, stock investors could earn nearly +20% for the next couple of years.

Compared to a 5-year Treasury bond yield of 0.7%, or cash returns of nearly 0%, it is hard to make a case against stocks for all but the most bearish investors.

In short, I am advising clients to maintain equity positions, and possibly increase weightings if a significant market sell-off occurs.