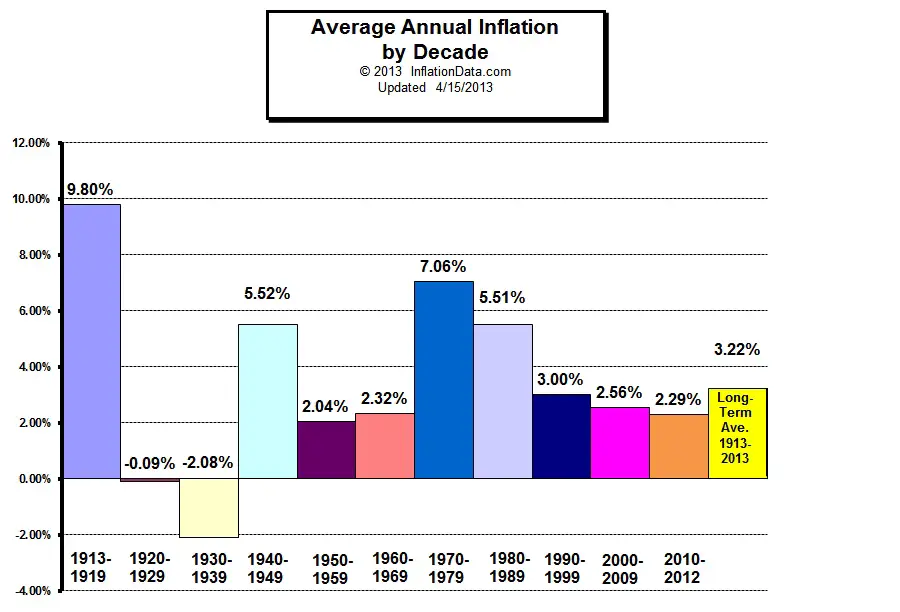

Today people who hold cash equivalents feel comfortable. They shouldn’t. They have opted for a terrible long-term asset, one that pays virtually nothing and is certain to depreciate in value. Indeed, the policies that government will follow in its efforts to alleviate the current crisis will probably prove inflationary and therefore accelerate declines in the real value of cash accounts.

Equities will almost certainly outperform cash over the next decade, probably by a substantial degree. Those investors who cling now to cash are betting they can efficiently time their move away from it later. In waiting for the comfort of good news, they are ignoring Wayne Gretzky’s advice: “I skate to where the puck is going to be, not to where it has been.”

http://www.nytimes.com/2008/10/17/opinion/17buffett.html?_r=0

The author of the piece, of course was Warren Buffett.

Although his market call was early - stocks would not actually bottom until March 2009 - investors who had heeded his advice would today seen the value of their portfolios double, as the chart above shows.

Investing is one of the few areas where age can be an asset. If you have followed the markets for a long period of time, you realize that while fluctuations in the market are inevitable, the longer term trend for stocks in the U.S. has been higher for nearly all of our country's history.

I have been working in the investment field for nearly 32 years. When I started in the business in January 1982 the Dow Jones Industrial average had just regained the 1,000 market. Today it stands at 16,000.

To be sure, there have been numerous "hiccups" along the way. But the longer term trend for stocks was higher, as it surely will be for the next 32 years.

Investing in stocks for the long run was also the mantra for a man named Alfred Feld. Feld started at Goldman Sachs in 1933, but eventually made his way to the investment management area where he worked for 80 years.

Feld died earlier this week, and today's Wall Street Journal carried his obituary. According to the Journal, Feld preferred blue chip stocks for his clients. He was also prescient to have avoided the technology bubble of late 1990's.

Away from the markets, Feld apparently was a fitness devotee as well as an investor. He felt that his work at the gym contributed to his long tenure as a trusted advisor:

In a 2003 interview with the Journal, when Mr. Feld was 88, he still worked four days a week and worked out regularly with a personal trainer in the Goldman gym. He said one of his main concerns was outliving his 40 or so clients.

“I see a lot of out-of-shape people here, and they would have a real hard time keeping up with him,” his trainer said at the time. “The first time I worked out with Al, he complained I didn’t do a good enough job working him because he wasn’t sore the next day.”

http://blogs.wsj.com/moneybeat/2013/11/26/alfred-feld-who-worked-at-goldman-80-years-dies-at-98/?KEYWORDS=alfred+feld