The official unemployment rate now stands at 7%, which is the lowest level in 5 years. Here's what the New York Times reported:

Employers have hired at least 200,000 workers in three of the last four months, including 203,000 in November. By contrast, as recently as July, when the economy seemed stuck in yet another summer swoon, only 89,000 new jobs were created...

The 7 percent unemployment rate last month — down from its most recent peak of 10 percent in October 2009 — is the best reading since President Obama took office, providing one bright spot for a White House beleaguered on many other fronts. The unemployment rate was 7.3 percent in December 2008, the month before Mr. Obama was inaugurated.

http://www.nytimes.com/2013/12/07/business/economy/us-economy-adds-203000-jobs-as-unemployment-falls-to-5-year-low.html?_r=0

However, relative to history, unemployment rates are unacceptably high.

I started After the Music Stopped: The Financial Crisis, the Response and the Work Ahead (New York: The Penguin Press, 24 Jan. 2013. ISBN 978-1594205309) last week.

Written by former Federal Reserve Vice Chairman Alan Blinder, the book has been cited as one of the best reviews of the 2007 - 2009 credit crisis.

So far, at least, I agree with the critics.

One of the points that Blinder makes early in his book is the tepid state of the current economic recovery. While the stock market has doubled from the March 2009, the economic recovery has been incredibly weak by historic standards.

Here's an excerpt from Blinder's book talking about unemployment (emphasis his):

During the quarter century from February 1984 through January 2009, Americans never witnessed an unemployment rate as high as 8 percent for even a single month. An entire generation entered the labor force and worked for decades without ever experiencing an unemployment rate as high as the lowest rate we had from February 2009 through August 2012....even unemployment rates above 7 percent were rare during this twenty-five year period.

So with Blinder's book in mind, I turned to the Federal Reserve of St. Louis to get more information on the current employment situation.

Unfortunately, I think I am seeing Blinder's point.

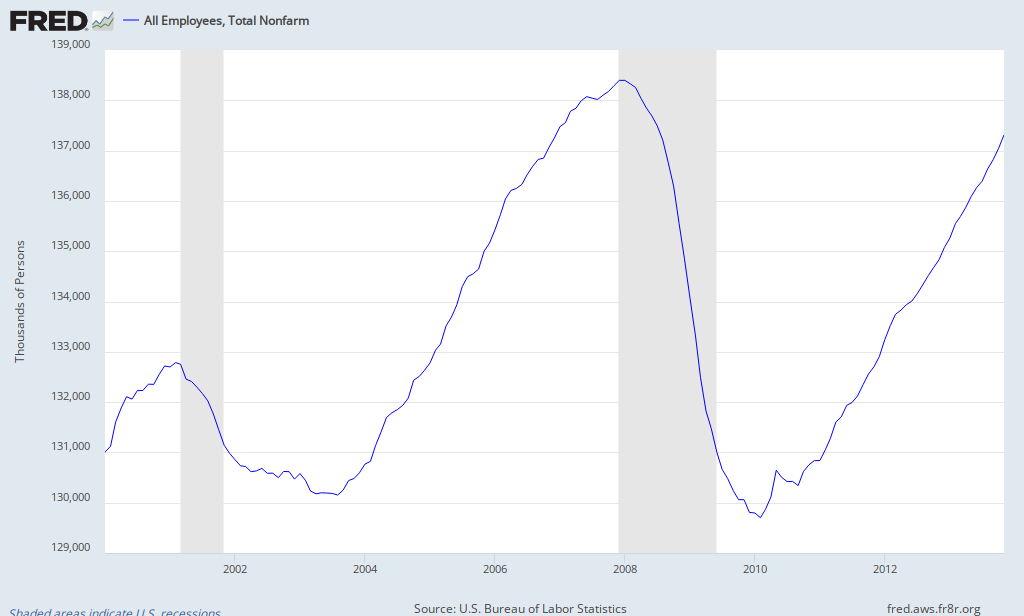

Look, for example, at the size of the total civilian workforce. Yes, it is up considerably from the lows five years ago, but still slightly lower than it was in 2007:

Labor participation rates are considerably lower as well. Even for workers with college degrees - normally considered the most "employable" - are considerably lower than a generation ago:

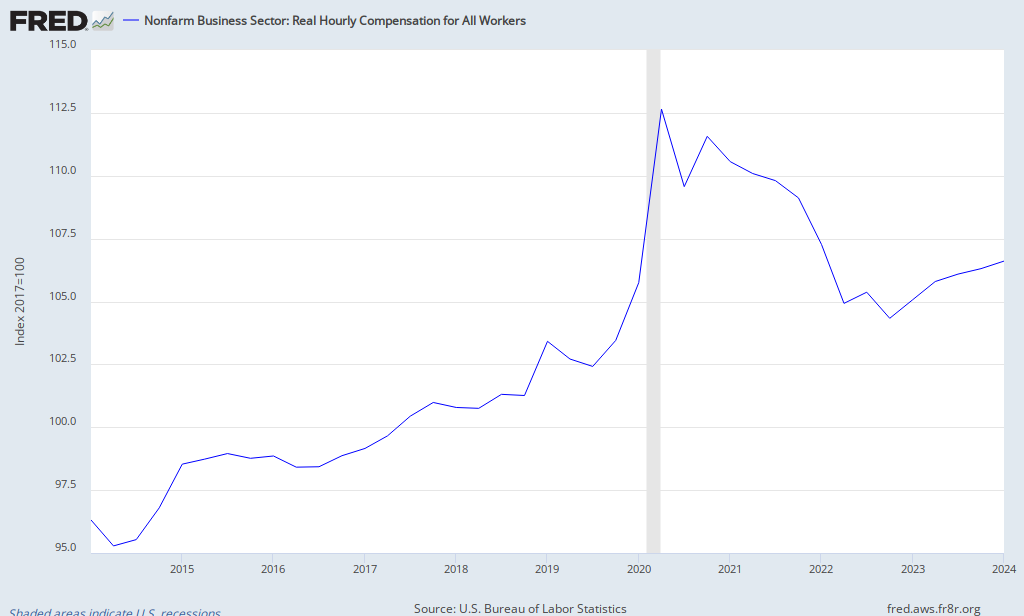

Not surprisingly, then, real income growth remains anemic:

The question that Wall Street economists are debating is when the Fed begins to "taper", i.e., reduce its presence in the credit markets.

Based on the current employment data, this date might be further away than many anticipate.

No comments:

Post a Comment