|

| source: InflationData.com |

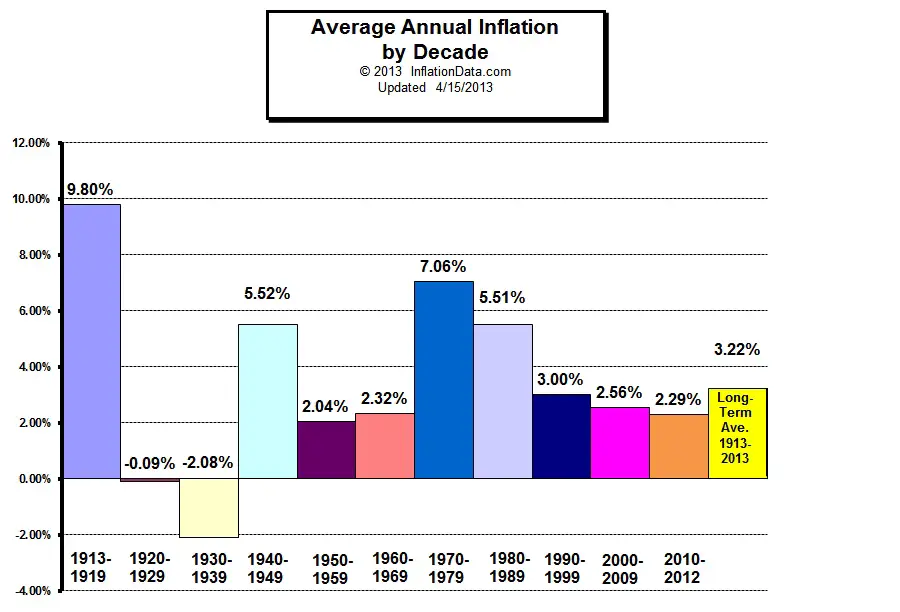

For most of my career - actually, for most of my life, come to think of it - one of the largest economic concerns in the U.S. has been inflation.

However, as the chart above indicates, the inflation I experienced in the 1970's and 1980's was actually more unusual than the norm. If you assume that the inflation in the 1940's was largely the result of World War II price pressures, it could really be argued that inflation for most of the 20th century really was not a big issue.

Now policymakers seem to be more worried about deflation than inflation.

The European Central Bank cut interest rates last week (over the objections of the Germans) citing deflationary pressures. Fed Chairman Bernanke has signaled that he too is worried about the threat of deflation, as did Janet Yellen in her testimony yesterday.

The implications of a sustained period of low or declining prices are too numerous for a short post, but sufficient to say that there is enough reason to consider a deflationary scenario.

Here's an excerpt from a Reuters piece earlier this week:

Deflation alone is not seen as an outright negative for equities, which can still rise if there is moderate growth.

But in such an environment, financial stocks tend to underperform because deflation increases a borrower's real debt burden, contributing to higher non-performing loans and lower net interest margins for banks as the gap between short- and long-term interest rates narrows.

"If we get a deflation psychology beginning to break out in Europe you have to reconsider the relationship between a 'risk' asset and 'non-risk' asset," said Bill O'Neill, chief UK investment strategist at UBS Wealth Management.

"Markets will be focusing on assets that provide nominal guaranteed returns such as government bonds. You would want to be aware of risks in equities, in particular in financials."

http://www.reuters.com/article/2013/11/13/us-investment-deflation-analysis-idUSBRE9AC06720131113

Deflation also would increase the credit risk of corporate bonds, since the cost of repaying debts would be rising in real terms.

Still, I think the jury is still out as to whether prices really are entering a sustained period of flat or negative trends.

No comments:

Post a Comment