It has been a common theme in recent weeks that stocks are in a "bubble". The argument is made that much of the recent market rise is due to investors irrationally ignoring a tepid economic environment and troubled political environment. These pundits argue that the day of reckoning is close at hand, and stocks are set for a nasty tumble.

Problem is, it is hard to find much evidence of investor euphoria.

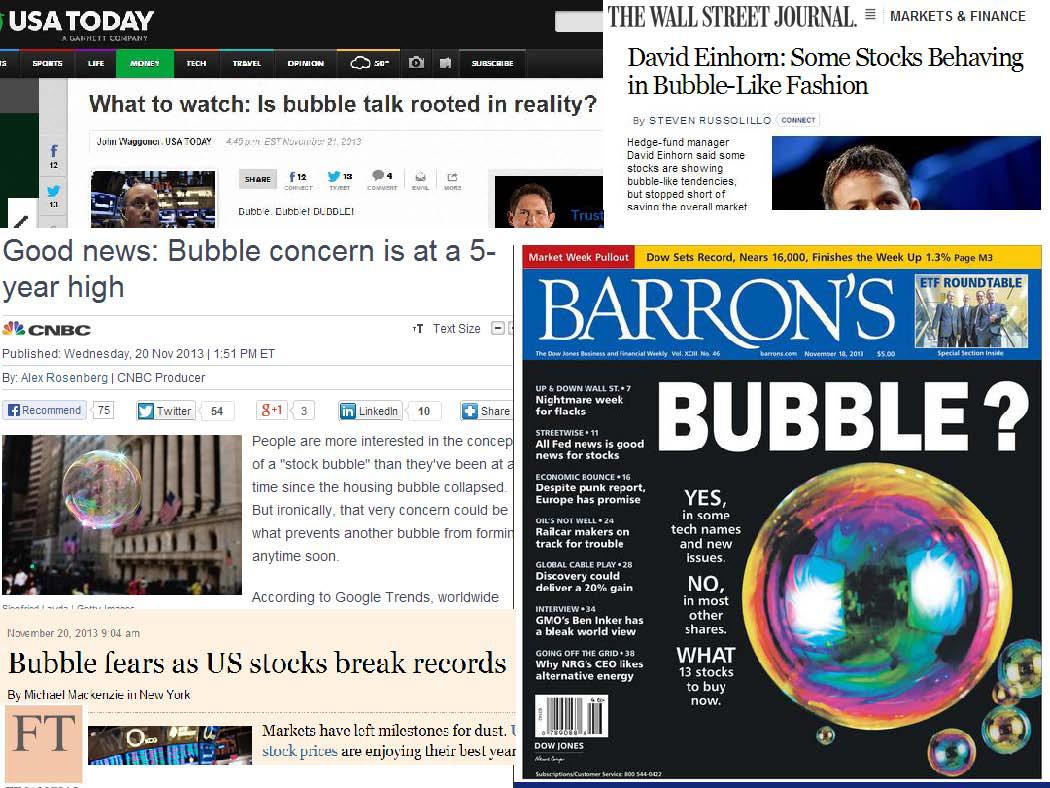

Here's a compilation of recent headlines that Slome put together for his post:

http://seekingalpha.com/article/1860231-confusing-fear-bubbles-with-stock-bubbles

Here's the lead paragraph from Slome's article:

With the Dow Jones Industrial Average approaching and now breaking the 16,000 level, there has been a lot of discussion about whether the stock market is an inflating bubble about to burst due to excessive price appreciation? The reality is a fear bubble exists…not a valuation bubble...

Volatility in stocks will always exist, but standard ups-and-downs don't equate to a bubble. The fact of the matter is if you are reading about bubble headlines in prominent newspapers and magazines, or listening to bubble talk on the TV or radio, then those particular bubbles likely do not exist. Or as strategist and investor Jim Stack has stated, "Bubbles, for the most part, are invisible to those trapped inside the bubble."

Bubbles occur when market prices diverge wildly from economic reality, and investor fears are nonexistent.

It seems more likely that much of the gains from 2009 reflect a market recovering from a vastly oversold condition.

Yes, market averages are higher than in 2007, but corporate America and the overall economy are also much larger.

Markets never move in one direction, so a correction of -10% or so would not be totally surprising. However, for the longer term investor, it would seem that this would represent an opportunity rather than a cause for panic.

No comments:

Post a Comment