I have been reading a book titled "Dark Pools: High-Speed Traders, A.I. Bandits and the Threat to the Global Financial System".

Written by Scott Patterson, the book describes how the old specialist system of the stocks exchanges has been gradually and then completely co-opted by quantitative models written by computer specialists who have completely changed the way stocks are traded - and largely not for the good.

The book is an eye-opener for anyone who trades stocks.

The "old" system was typified by a specialist standing on the floor of the New York Stock Exchange, making a market in a group of stocks. Trading was usually orderly, and prices moved in increments of eighths.

That changed in 2000, when the system of quoting stock prices moved from fractions to pennies, a process described as "decimalization".

The thinking was straightforward: being a specialist on the NYSE was largely a license to print money, since the firms were really only making markets, and pocketing the difference between the bid and ask prices. Lower spreads would presumably put more money in the pockets of investors rather than the specialists.

But that's not how it has turned out, and the markets are the poorer for it.

Not only are the equity markets being dominated by computers trading shares in a time frame measured in nanoseconds, but smaller less liquid shares are being largely ignored, since the miniscule spreads make it unprofitable for dealers to traffic in all but the most actively traded large cap stocks.

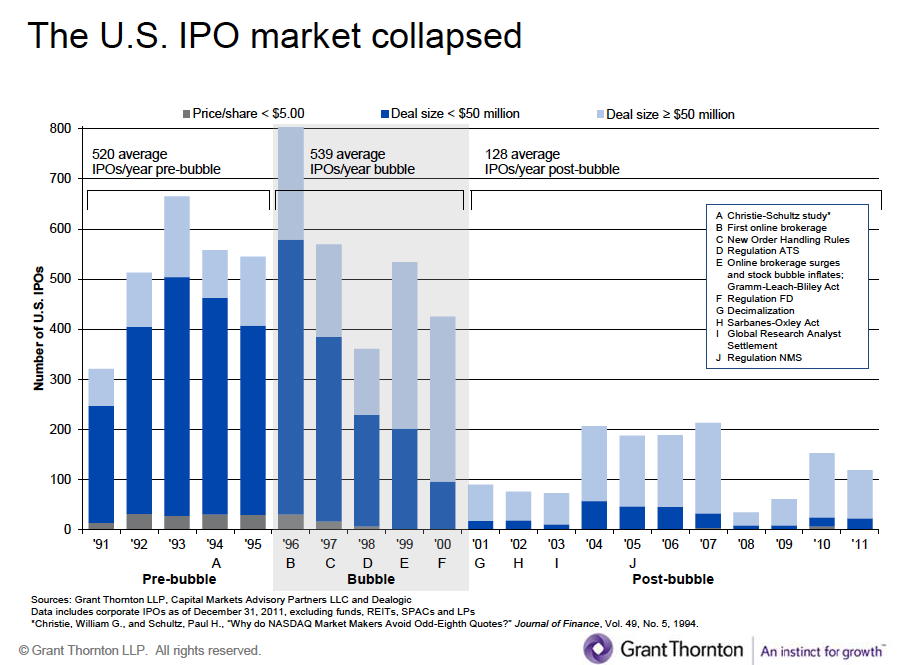

By definition, most IPO's are small companies seeking to raise capital, but if the liquidity in the small cap market is gone it effectively closes the window on most IPO activity.

Regardless of your feeling about IPO's, they are an important part of our economy. Small successful companies need capital to grow and create jobs, but if the capital markets window is shut our economy is impacted.

Here's what author Robert Cringely - who has followed the technology industry for decades - wrote on his blog I, Cringely:

Decimalization made High Frequency (automated) Trading possible — a business tailor-made for trading large capital companies at the expense of small caps and IPOs. Add to this the rise of index and Exchange Traded Funds and all the action was soon in large cap stocks. Market makers were no longer supporting small caps by being a willing buyer to every seller. Big IPOs like General Motors flourished while little Silicon Valley IPOs dramatically declined.

There are 40 percent fewer U.S. public companies now than in 1997 (55 percent fewer by share of GDP) and twice as many companies are being delisted each year as newly listed. Computers are trading big cap shares like crazy, extracting profits from nothing while smaller companies have sharply reduced access to growth capital, forcing them at best into hasty mergers.

Yes, commissions are smaller with decimalization but it turns out that inside that extra $0.0525 of the old one-sixteenth stock tick lay enough profit to make it worthwhile trading broadly those smaller shares.

Decimalization pulled liquidity out of the market, especially for small cap companies, hurting those companies in the process. Markets and market makers consolidated, which also proved bad for small caps and their IPOs. Wall Street consolidation was good for big banks but bad for everyone else.

http://www.cringely.com/2012/09/05/ticked-off-how-stock-market-decimalization-killed-ipos-and-ruined-our-economy/

The debacle of the Facebook IPO earlier this year has been widely cited as the reason that the IPO market has been so weak this year. But I suspect that the real culprit is the changing nature of the stock market trading mechanics, as Cringely writes.

Cringely cites a presentation by David Weild of Granton Thornton as the source for much of his data, including the chart shown above. Here's the link to Mr. Weild's very informative presentation:

http://nowstreetjournal.files.wordpress.com/2011/03/weild-atlanta-presentation-dara.pdf

No comments:

Post a Comment