At the federal level, where dividends are currently taxed at a 15% level, tax rates could rise to as high as 43.4% for taxpayers in the highest tax bracket (including the 3.8% investment tax under the new Affordable Care Act).

Capital gains rates, meanwhile, will also rise, but not nearly as much. At the federal level, long term capital gains are taxed at 15%, even at the highest income level. Next year, unless Congress acts, the top rate will rise to 23.8% (again, including the 3.8% under ACA).

So what will be the effect on dividend-paying stocks?

No one knows for certain, of course, but mutual fund giant Fidelity put out a piece recently essentially saying that higher taxes on dividends will probably not have too much of an impact.

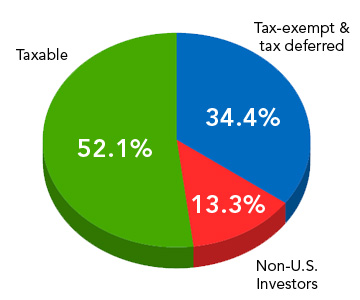

They cite a couple of reasons. First, only about half of equities held by individuals are in taxable accounts, as this chart shows.

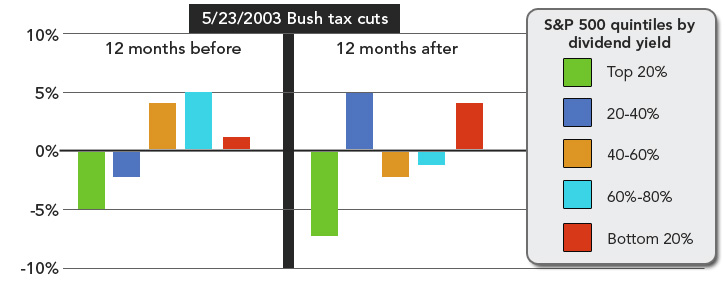

Next, Fidelity went back to 2003, when taxes were first cut to the current levels under the Bush administration. Logically, a tax cut on dividends should have lead to outperformance by the highest yielding stocks, but that actually the opposite occurred:

You can read the whole report for yourself, but I suspect that Fidelity's relatively sanguine view is correct.

https://www.fidelity.com/viewpoints/investing-ideas/dividend-tax-fallout?ccsource=email_weekly

No comments:

Post a Comment