For reasons explained below, the next Random Glenings will be published Monday, October 1, 2012.

My wife and I are heading to Madrid tomorrow night.

This is our second trip to Spain this year - we went to Barcelona in April - and we are very much looking forward to our week of travel.

Spain, of course, is in the epicenter of the euro crisis. Over the last few weeks, the European Central Bank has produced billions in euros to try to help Spain's struggling banking system. Here's an excerpt from the New York Times on the latest bailout efforts:

Spain has also been promised up to 100 billion euros in aid for

restructuring its banking sector...

Spain’s main problems — a stumbling economy and a broken labor market —

have been compounded by fears of a euro breakup and capital flight from

its troubled banks. The country appears unlikely to gain any short-term

help from a pickup in the economy, a survey of purchasing managers in

the euro zone showed Thursday.

http://www.nytimes.com/2012/09/21/business/global/daily-euro-zone-watch.html

But here's the interesting part.

I was talking to a client earlier this week who had just returned from 8 days in Spain. He and his wife traveled to several cities in Spain, including Madrid, Barcelona, Toledo and Granada.

It was puzzling, he said, to compare the dire economic reports in the media with the bustling streets that he saw firsthand. The restaurants were full, the shopping areas packed, and the streets full of people enjoying the beautiful early fall Spanish weather.

His experience was similar to our experience last spring. Although Barcelona had experienced riots outside of the Barcelona stock exchange two weeks before our visit, the shops and restaurants were full and vibrant. My wife and I even enjoyed a very pleasant cup of coffee at an outdoor cafe right outside the exchange, nary a protester in sight.

Now, to be sure, anecdotal evidence is very unreliable when it comes to making economic judgements. We talked to a couple who live in Barcelona, and they said that under the apparently prosperous surface the local economy was struggling.

But there was a column in yesterday's London Guardian that questioned the assumption that life was hard for most Europeans.

Titled "Europe is Still the Closest Thing to Paradise on Earth", Remi Adeyoka discussed the paradox between the on-going euro crisis and the incredible lifestyle of many Europeans:

Listening to all the gloom and doom on the news these days, I

sometimes catch myself actually starting to feel sorry for people living

in Europe. Then I tell myself I must be mad. Even with a crisis,

Europeans still enjoy just about the safest, healthiest and wealthiest lives on the planet.

According to the UN human development index (HDI),

which measures life expectancy, literacy, education levels and

standards of living in a country, six of the 10 most developed nations

in the world are in Europe.

And when the HDI takes into

account inequality, nine out of the 10 best-performing nations are

European, proof that the old continent has been the most effective in

creating the least stratified societies.

http://www.guardian.co.uk/commentisfree/2012/sep/19/europe-paradise-on-earth?INTCMP=SRCH

Americans, of course, are fond of saying that Europeans are enjoying a lifestyle they cannot afford. And while this might be true, it is also true (quoting Mr. Adeyoka):

The US offers more opportunity to the gifted, the entrepreneurial and

the rich than Europe does. But those who don't fall into those

categories are better off here. Were the average American blue-collar

worker to see how his German, Dutch or British peers live, and the

quality of healthcare and education accessible to them, he might start

wondering if his country is indeed "the greatest nation on earth", as

American politicians love to say. And let's not forget that US national

debt is more than 100% of its GDP compared to the 83% for the EU, even

with its often derided "welfare state".

See you in October!

Friday, September 21, 2012

Thursday, September 20, 2012

Fidelity: Don't Fear A Dividend Tax Hike

If Congress doesn't act before year-end, taxes on dividend paid to individuals will increase significantly in 2013.

At the federal level, where dividends are currently taxed at a 15% level, tax rates could rise to as high as 43.4% for taxpayers in the highest tax bracket (including the 3.8% investment tax under the new Affordable Care Act).

Capital gains rates, meanwhile, will also rise, but not nearly as much. At the federal level, long term capital gains are taxed at 15%, even at the highest income level. Next year, unless Congress acts, the top rate will rise to 23.8% (again, including the 3.8% under ACA).

So what will be the effect on dividend-paying stocks?

No one knows for certain, of course, but mutual fund giant Fidelity put out a piece recently essentially saying that higher taxes on dividends will probably not have too much of an impact.

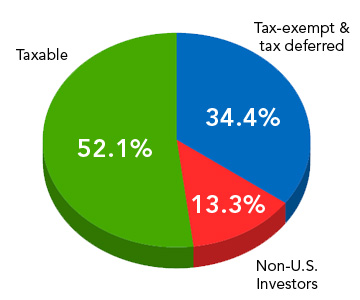

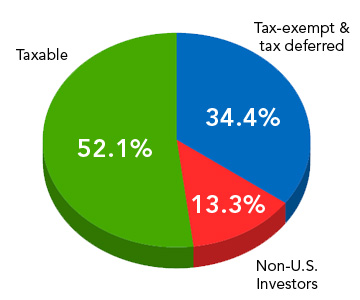

They cite a couple of reasons. First, only about half of equities held by individuals are in taxable accounts, as this chart shows.

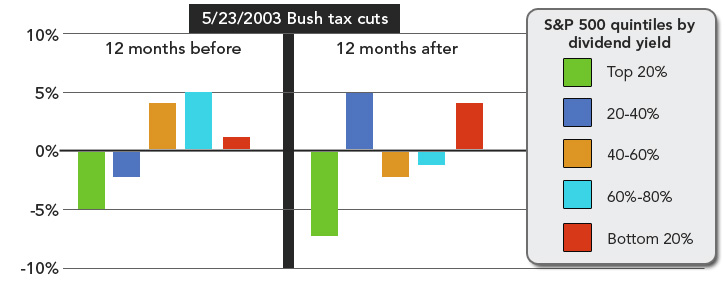

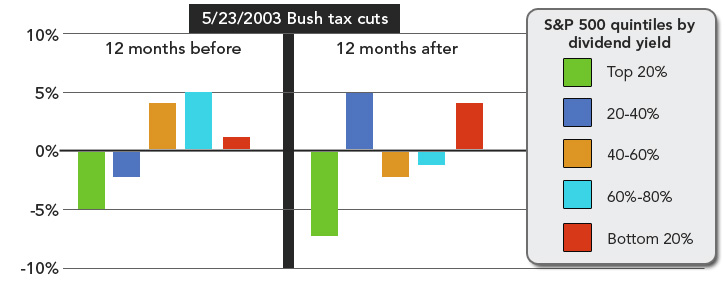

Next, Fidelity went back to 2003, when taxes were first cut to the current levels under the Bush administration. Logically, a tax cut on dividends should have lead to outperformance by the highest yielding stocks, but that actually the opposite occurred:

You can read the whole report for yourself, but I suspect that Fidelity's relatively sanguine view is correct.

https://www.fidelity.com/viewpoints/investing-ideas/dividend-tax-fallout?ccsource=email_weekly

At the federal level, where dividends are currently taxed at a 15% level, tax rates could rise to as high as 43.4% for taxpayers in the highest tax bracket (including the 3.8% investment tax under the new Affordable Care Act).

Capital gains rates, meanwhile, will also rise, but not nearly as much. At the federal level, long term capital gains are taxed at 15%, even at the highest income level. Next year, unless Congress acts, the top rate will rise to 23.8% (again, including the 3.8% under ACA).

So what will be the effect on dividend-paying stocks?

No one knows for certain, of course, but mutual fund giant Fidelity put out a piece recently essentially saying that higher taxes on dividends will probably not have too much of an impact.

They cite a couple of reasons. First, only about half of equities held by individuals are in taxable accounts, as this chart shows.

Next, Fidelity went back to 2003, when taxes were first cut to the current levels under the Bush administration. Logically, a tax cut on dividends should have lead to outperformance by the highest yielding stocks, but that actually the opposite occurred:

You can read the whole report for yourself, but I suspect that Fidelity's relatively sanguine view is correct.

https://www.fidelity.com/viewpoints/investing-ideas/dividend-tax-fallout?ccsource=email_weekly

Wednesday, September 19, 2012

The Global Central Banks Keep Markets Buoyant

I've been attending a conference here in Boston sponsored by Citigroup that focuses on companies in the industrial space.

Companies like General Electric; United Technologies; and Danaher are all presenting to members of the investment community. My clients own stock in some of these companies, but even if I am not investing in a particular stock I usually learn from hearing a presentation.

The general mood of the conference is somber.

Many presenters are discussing a marked slowdown in their global business. Interestingly, although the recent attention of the financial community has been on Europe, most of the company managements that I have heard so far are very concerned about the emerging markets, particularly China.

Early this week FedEx chairman Fred Smith was blaming a sharp deceleration in Chinese economic activity as the primary culprit for FedEx's disappointing earnings release. Here's what Fortune magazine reported:

FORTUNE – FedEx, the world's largest air package shipper, sounded the alarms this week on what many corporate executives have feared: China's slowing growth. The world's second-largest economy helped drive global growth when many other economies, including the U.S. and Europe, were still struggling from the global financial crisis.

FedEx CEO Fred Smith on Tuesday warned economic problems in Europe and the U.S. have slowed trade around the world. And he said the impact on China's economy is far bigger than what most observers have estimated. FedEx is a closely watched economic bellwether, as the volume of its shipments offer a broad glimpse of how economies are doing. Already, the company trimmed the amount of planes carrying shipments into the U.S.

http://finance.fortune.cnn.com/2012/09/19/fedex-china/

Today, Eaton Corporation CEO Sandy Cutler also discussed the slowdown in China.

Eaton thinks that China's growth rate is only half of what the government is reporting, which would put it in the +3% range. Not bad compared to the U.S., perhaps, but a far cry from the +9% growth rates of a couple of years ago.

And it's not just China. Brazil and India are also experiencing massive slowdowns in their growth rates, largely because of government policies aimed both at slowing inflation as well as protecting local jobs.

Normally reports like these would cause moderately bullish investors like me to head to the sidelines. But not it's not time to head for shelter just yet, in my opinion, because the world's central banks are engaged in probably the most radical experiment in monetary intervention that we have seen in modern times.

Last night the Bank of Japan followed the U.S. Federal Reserve in massively intervening in the credit markets in an effort to try to reinvigorate the local economy. Here's the New York Times this morning:

http://www.nytimes.com/2012/09/20/business/global/japanese-central-bank-expands-asset-buying-to-bolster-economy.html?hpw

The fundamentals ain't great, but the world's central banks have unleashed a tsunami of liquidity into the capital markets.

And if central banks want asset prices to go higher, it will be difficult to argue.

Companies like General Electric; United Technologies; and Danaher are all presenting to members of the investment community. My clients own stock in some of these companies, but even if I am not investing in a particular stock I usually learn from hearing a presentation.

The general mood of the conference is somber.

Many presenters are discussing a marked slowdown in their global business. Interestingly, although the recent attention of the financial community has been on Europe, most of the company managements that I have heard so far are very concerned about the emerging markets, particularly China.

Early this week FedEx chairman Fred Smith was blaming a sharp deceleration in Chinese economic activity as the primary culprit for FedEx's disappointing earnings release. Here's what Fortune magazine reported:

FORTUNE – FedEx, the world's largest air package shipper, sounded the alarms this week on what many corporate executives have feared: China's slowing growth. The world's second-largest economy helped drive global growth when many other economies, including the U.S. and Europe, were still struggling from the global financial crisis.

FedEx CEO Fred Smith on Tuesday warned economic problems in Europe and the U.S. have slowed trade around the world. And he said the impact on China's economy is far bigger than what most observers have estimated. FedEx is a closely watched economic bellwether, as the volume of its shipments offer a broad glimpse of how economies are doing. Already, the company trimmed the amount of planes carrying shipments into the U.S.

http://finance.fortune.cnn.com/2012/09/19/fedex-china/

Today, Eaton Corporation CEO Sandy Cutler also discussed the slowdown in China.

Eaton thinks that China's growth rate is only half of what the government is reporting, which would put it in the +3% range. Not bad compared to the U.S., perhaps, but a far cry from the +9% growth rates of a couple of years ago.

And it's not just China. Brazil and India are also experiencing massive slowdowns in their growth rates, largely because of government policies aimed both at slowing inflation as well as protecting local jobs.

Normally reports like these would cause moderately bullish investors like me to head to the sidelines. But not it's not time to head for shelter just yet, in my opinion, because the world's central banks are engaged in probably the most radical experiment in monetary intervention that we have seen in modern times.

Last night the Bank of Japan followed the U.S. Federal Reserve in massively intervening in the credit markets in an effort to try to reinvigorate the local economy. Here's the New York Times this morning:

TOKYO — The Japanese central bank moved to ease monetary policy

Wednesday, saying it would buy larger quantities of government bonds and

other assets, following the U.S. Federal Reserve in a show of resolve

to shore up a shaky economic recovery.

The central bank, the Bank of Japan,

will expand its asset purchase and loan program by ¥10 trillion, or

$126 billion, to ¥80 trillion, the bank announced after a two-day board

meeting that ended Wednesday. The purchase program was also extended six

months, to the end of 2013.

The program aims to stimulate stronger economic growth by adding to bank

reserves and driving down the cost of lending, prompting more money to

flow through the economy.

http://www.nytimes.com/2012/09/20/business/global/japanese-central-bank-expands-asset-buying-to-bolster-economy.html?hpw

The fundamentals ain't great, but the world's central banks have unleashed a tsunami of liquidity into the capital markets.

And if central banks want asset prices to go higher, it will be difficult to argue.

Tuesday, September 18, 2012

Markets Remain Bid Despite Weakish Fundamentals

The S&P 500 is up nearly +4% this month.

While there are 9 trading days left in the month, it now seems likely that the seasonal weakness that historically occurs in September will not happen in 2012.

In other words, the September market swoon that many were expecting has not yet happened.

The Fed, of course, has played a major role in the recent rally, with last week's announcement of additional quantitative easing targeted at reducing unemployment.

There is now a number of indicators suggesting that both the European Central Bank and the Bank of Japan may take similar actions before the end of the year.

And, as my post yesterday suggested, if the world's central banks want asset prices to move higher, it seems difficult to bet against them.

At the same time, recent economic and corporate datapoints would normally cause stock investors to head to cash, but playing it safe has not been a winning strategy so far this year.

As the Financial Times noted in its "Lex Column" this morning:

Perhaps the most horrifying thing about the current combination of sales deceleration, margin contraction and high valuations is that it might not even be a sell signal. The central banks of the US and Europe may well keep investors trapped in risky assets indefinitely. Those who look at the fundamentals and flee to cash had better be patient.

http://www.ft.com/home/us

In other words, the Pain Trade - the painful tendency of markets to go in the opposite direction of consensus forecasts - is in full force.

I went to hear Credit Suisse global strategist Andrew Garthwaite yesterday. Besides distributing the largest stack of presentation charts I have seen in many years (almost 565 pages of material!), Garthwaite colorfully described the despair of bearish institutional investors.

"I have just been traveling in Europe the past couple of weeks," he said, "and I can tell you there is palatable pain being felt among the investment community as markets move higher. Institutions have totally missed this move."

Using the Vanguard European ETF as a proxy, European markets are up nearly +25% since the beginning of June:

Garthwaite noted that most pension funds and insurance companies are at near-record low levels in equity allocations. This is similar to institutions in the U.S.; equity weightings of U.S. pension funds have not been this low in over 50 years.

Gathwaite indicated that most of the clients he spoke with are holding their breath, and hoping that the long-awaited market correction will occur in short order.

But, he noted with a grin, what happens if markets keep grinding higher?

Monday, September 17, 2012

If the Fed Wants You To Buy Stocks, Should You Listen?

Merrill Lynch strategist Savita Subramanian is out today with a nice summary of where we stand in the markets (I added the emphasis):

...investors should continue to favour income-generating investments. The whole point of QE is to suppress bond yields and to keep the real, inflation-adjusted cost of servicing government debt low, and preferably negative, for as many years as it takes to get the ship back on an even keel.

This so-called “financial repression” endured for a decade or more after the Second World War and it was many years then before the chickens came home to roost in the form of 1970s stagflation. Sustainability of dividend is the key because there are plenty of high-yield “traps” waiting for the unwary investor, but there is no shortage of blue-chips offering reliably high and growing dividend streams.

http://www.telegraph.co.uk/finance/comment/9545346/How-investors-can-ride-this-QE-wave-of-monetary-stimulus.html

Finally, writing on the CNBC blog, columnist Ross Westgate revisits all of those "Sell in May and Go Away" predictions that you probably were reading last spring and notes the following:

Since May 1, the FTSE [.FTSE 5888.75 -26.80

(-0.45%)

-26.80

(-0.45%)

] has risen just over 100 points, most of that in the last week providing gains of 1.75 percent In the U.S the S&P 500 [.SPX

1463.39

] has risen just over 100 points, most of that in the last week providing gains of 1.75 percent In the U.S the S&P 500 [.SPX

1463.39

-2.38

(-0.16%)

-2.38

(-0.16%)

]

is up over 60 points or 4.45 percent but the standout has been equities

in the poor afflicted euro zone. In the same period the Euro Stoxx 50 [.STOXX50E

2583.14

]

is up over 60 points or 4.45 percent but the standout has been equities

in the poor afflicted euro zone. In the same period the Euro Stoxx 50 [.STOXX50E

2583.14

-11.42

(-0.44%)

-11.42

(-0.44%)

] has risen over 200 points, a near 11 percent return.

] has risen over 200 points, a near 11 percent return.

Equity sentiment has hit 27-year lows, and the S&P 500 is now

trading at the widest discount to bonds that

we have seen in the history of our data. But

the market has trended up for most of the year,

and the recent rally on dovish comments from

the Fed puts the S&P

500 up by 16% for 2012. Despite demonstrable underperformance of bonds and cash for most

of the year, outflows from equities into bonds have been the dominant trend,

and only recently have we seen this reverse course.

It would not be surprising to me to see the markets have a pullback in here after such a strong run in recent weeks.

But the tape still trends positive, and the Fed is doing everything it can to make staying in cash a very expensive proposition.

Writing in the London Telegraph, columnist Tom Stevenson wrote a good piece about how investors should be positioned.

His bottom line: buy stocks, but favor those with healthy dividends.

Stevenson notes that the Fed's actions will eventually lead to more inflation (the rise in longer term bond yields last week already anticipates higher inflation rates) but this may not occur for several years to come.

Stevenson compares the current period of financial repression to the post World War II period:

...investors should continue to favour income-generating investments. The whole point of QE is to suppress bond yields and to keep the real, inflation-adjusted cost of servicing government debt low, and preferably negative, for as many years as it takes to get the ship back on an even keel.

This so-called “financial repression” endured for a decade or more after the Second World War and it was many years then before the chickens came home to roost in the form of 1970s stagflation. Sustainability of dividend is the key because there are plenty of high-yield “traps” waiting for the unwary investor, but there is no shortage of blue-chips offering reliably high and growing dividend streams.

http://www.telegraph.co.uk/finance/comment/9545346/How-investors-can-ride-this-QE-wave-of-monetary-stimulus.html

Finally, writing on the CNBC blog, columnist Ross Westgate revisits all of those "Sell in May and Go Away" predictions that you probably were reading last spring and notes the following:

Since May 1, the FTSE [.FTSE 5888.75

-26.80

(-0.45%)

-26.80

(-0.45%)

-2.38

(-0.16%)

-2.38

(-0.16%)

-11.42

(-0.44%)

-11.42

(-0.44%)

Clearly selling was not the best decision,

but as Seven's Justin Urquhart Stewart points out, it's worse than

that. Because in the May - September period ''not only would you have

lost the income, but also incurred the costs of selling and buying back

and suffered the further losses of the bid–offer spreads. All in all, a

complete waste of time, money and worry.''

In other words, while I might be a little cautious near-term, history would suggest that when the world's central banks want you to buy stocks perhaps you should just go along for the ride.

Friday, September 14, 2012

The Era of Finanical Repression Continues

Writing in the Financial Times last May, columnist Gillian Tett wrote an excellent column discussing our current era of "financial repression".

Coined originally by economists Carmen Reinhart and Belen Sbrancia, the term describes the negative effects that low interests are having on the world's capital markets.

Interest rates have been moved to historically low levels in most of the developed world's economies in an attempt to rekindle economic growth and restore the banking system to health.

Whether this has been successful or not is an open question. It would appear, for example, that the health of the U.S. banking system has been greatly improved by the actions of the Fed and Treasury, while the recovery in the European banking system has been delayed by partisan bickering.

Economic growth, however, remains anemic, and yesterday's announcement of a third round of quantitative easing by the Fed is targeted at reducing our stubbornly high unemployment rate is a recognition that government economic policies have more work ahead.

What is clear, however, is that the bulk of the "pain" of the uber-low interest policies is being felt by savers and investors.

Ms. Tett's column last May marveled the apparent indifference that bond investors had to buying bonds with yields below the current rate of inflation.

With the Fed's announcement that short term interest rates will stay at essentially zero through the middle of 2015 - three more years! - bonds are either a sucker bet or an incredibly expensive way to make sure that you'll at least have some cash a few years from now.

Here's what she wrote:

Anybody buying Treasuries, in other words, is essentially agreeing to subsidize the US government in coming years - unless you believe that deep deflation looms. Call it, if you like, a form of voluntary repression; either way, it will almost certainly end up helping the US state, to the detriment of investors.

http://www.ft.com/home/us

This subsidy, by the way, is not insignificant. Here's an excerpt from a piece that appeared in the New York Times earlier this week (I added the emphasis):

In the nearly four years that the Fed set its benchmark interest rate at zero, the government has saved trillions of dollars in interest payments. If interest rates today were what they were in 2007, the Treasury would be paying about twice as much to service its debt.

http://www.nytimes.com/2012/09/11/business/as-low-rates-depress-savers-governments-reap-the-benefits.html?_r=1&pagewanted=all

The bond market finally seems to be sensing that it is picking up the tab for government profligacy.

While interest rates on shorter maturities are unchanged - which seems perfectly rational in light of yesterday's announcement - longer maturity bond yields are soaring. Ten year Treasury bond yields now stand at 1.86%, or more than 40 basis points higher than just two months ago.

My thinking: the bond market is finally waking up to the idea that the Fed is going to whatever it takes to get the economy going, inflation be damned.

And they probably will succeed, meaning growth will be stronger a few years from now but inflation will also be higher.

If this is right, stocks should also work, although they feel a little frothy right now.

Coined originally by economists Carmen Reinhart and Belen Sbrancia, the term describes the negative effects that low interests are having on the world's capital markets.

Interest rates have been moved to historically low levels in most of the developed world's economies in an attempt to rekindle economic growth and restore the banking system to health.

Whether this has been successful or not is an open question. It would appear, for example, that the health of the U.S. banking system has been greatly improved by the actions of the Fed and Treasury, while the recovery in the European banking system has been delayed by partisan bickering.

Economic growth, however, remains anemic, and yesterday's announcement of a third round of quantitative easing by the Fed is targeted at reducing our stubbornly high unemployment rate is a recognition that government economic policies have more work ahead.

What is clear, however, is that the bulk of the "pain" of the uber-low interest policies is being felt by savers and investors.

Ms. Tett's column last May marveled the apparent indifference that bond investors had to buying bonds with yields below the current rate of inflation.

With the Fed's announcement that short term interest rates will stay at essentially zero through the middle of 2015 - three more years! - bonds are either a sucker bet or an incredibly expensive way to make sure that you'll at least have some cash a few years from now.

Here's what she wrote:

Anybody buying Treasuries, in other words, is essentially agreeing to subsidize the US government in coming years - unless you believe that deep deflation looms. Call it, if you like, a form of voluntary repression; either way, it will almost certainly end up helping the US state, to the detriment of investors.

http://www.ft.com/home/us

This subsidy, by the way, is not insignificant. Here's an excerpt from a piece that appeared in the New York Times earlier this week (I added the emphasis):

In the nearly four years that the Fed set its benchmark interest rate at zero, the government has saved trillions of dollars in interest payments. If interest rates today were what they were in 2007, the Treasury would be paying about twice as much to service its debt.

http://www.nytimes.com/2012/09/11/business/as-low-rates-depress-savers-governments-reap-the-benefits.html?_r=1&pagewanted=all

The bond market finally seems to be sensing that it is picking up the tab for government profligacy.

While interest rates on shorter maturities are unchanged - which seems perfectly rational in light of yesterday's announcement - longer maturity bond yields are soaring. Ten year Treasury bond yields now stand at 1.86%, or more than 40 basis points higher than just two months ago.

My thinking: the bond market is finally waking up to the idea that the Fed is going to whatever it takes to get the economy going, inflation be damned.

And they probably will succeed, meaning growth will be stronger a few years from now but inflation will also be higher.

If this is right, stocks should also work, although they feel a little frothy right now.

Thursday, September 13, 2012

Invest As If You Don't Know What The Future Will Hold

Ray Dalio runs Bridgewater Associates, the world's largest hedge fund and probably the most successful.

I wrote several pieces last year about Mr. Dalio. Last October, for example, he had just been interviewed on the PBS show Charlie Rose, and I had been very impressed on what I had heard.

Here's what I wrote in my October 25, 2011, blog posting:

Ray Dalio is one of the most successful money managers of our generation. Starting in 1975, his firm now manages approximately $125 billion for a wide variety of clients, including some of the largest public pension plans. Last year, Bridgewater was the top performing hedge fund in the United States, proving that size isn't necessary a deterrent to performance....

I wrote several pieces last year about Mr. Dalio. Last October, for example, he had just been interviewed on the PBS show Charlie Rose, and I had been very impressed on what I had heard.

Here's what I wrote in my October 25, 2011, blog posting:

Ray Dalio is one of the most successful money managers of our generation. Starting in 1975, his firm now manages approximately $125 billion for a wide variety of clients, including some of the largest public pension plans. Last year, Bridgewater was the top performing hedge fund in the United States, proving that size isn't necessary a deterrent to performance....

One of the most interesting parts of the interview, in my opinion,

is how much Mr. Dalio says that his firm focuses on what they don't

know. Unlike many investors - who make a specific forecast, then invest

accordingly - Bridgewater considers a wide range of scenarios, and

tries to figure out investments that will do well in a variety of

different outcomes.

In this tendency

Bridgewater is not alone. It seems to me most of the best investors -

including Warren Buffett - spend more time on downside risks than they

do opportunities. Despite their enormous success, Dalio and Buffett are

humble enough to recognize that events often take place that virtually

no can anticipate, and they make their investments accordingly.

Dalio was interviewed recently by Maria Bartiromo of CNBC. It was a long interview - almost an hour - but I liked what he described as his approach to asset allocation.

Here's an excerpt from the blog Business Insider:

First, Dalio explains what you need to think about when setting up a portfolio. The key here is asset allocation.

"So I think I'm going to answer it in the

following way that I think that is the right way for people to look at

it. It's the way I look at it. I think that the first thing is

you should have a strategic asset allocation mix that assumes that you

don't know what the future is going to hold. And I think most people should..."

Dalio's thoughts are consistent with Vanguard founder John Bogle's idea that patient investing based on long-term thinking are the best way for most people to handle their investments.

Here's the entire interview:

Wednesday, September 12, 2012

Staying Invested

Bloomberg Businessweek had an interesting piece yesterday noting the apparent inconsistency of a faltering corporate economy and the relentless rise in stock prices this year.

Here's an excerpt:

In

the face of all that, Standard & Poor’s 500-stock index is up 25

percent over the past 12 months, and 14 percent in 2012. Stocks have

reached levels unseen since before the fall of Lehman Brothers and Bear

Stearns. “This is about the strangest market environment I’ve ever

seen,” says Donald Luskin, chief investment officer at Trend

Macrolytics.

http://www.businessweek.com/articles/2012-09-11/how-did-stocks-get-so-high

Even though I remain bullish on stocks, and believe the broader market averages will be higher by the end of this year, I must confess that I am becoming a little uneasy with the rising bullish sentiment.

Strong market runs rarely start when sentiment skews positive, as it is currently. Random Glenings fave Ned Davis noted this morning that his firm's Crowd Sentiment Poll shows 68% of active managers surveyed are bullish on the prospects for the market, which is towards the higher end of historic averages.

In addition, Mr. Davis points out:

It seems to me that conventional wisdom on Wall Street is that while earnings estimates are being cut a little, still profits are coming in better than expected, and growth should continue. It is true that total corporate earnings have risen this year, but when one looks at the median stock, earnings have actually been flat this year...

...the median P/E ratio of the S&P 500 stocks was 17.6 at the end of August. That means half of the 500 stocks had higher P/Es, and half had lower. A P/E of 17.6 is not that excessive, but it is not cheap, either. Fair value is 1313 on the S&P 500.

http://www.ndr.com/scrndr/servlet/EProduct/BPK006/HOT201209121.PDF?id=159192

So what should you do?

If history is any guide, you probably should do nothing.

More money - both real and opportunistic - has been lost by trying to time the market. The longer run prospects for the stock market remains positive, especially compared to the alternatives, so if your overall asset allocation is comfortable you probably should just go outside and enjoy the beautiful fall weather.

Here's an excerpt from a recent Reuters interview with Vanguard founder John Bogle that offers some perspective (I added the emphasis):

Q: Any advice for people about where they should invest going forward?

A: Stock returns basically come down to dividend yield plus earnings growth. If you have a dividend yield of 2 percent, plus earnings growth of 5 percent, I think a 7 percent annual gain is a rational expectation for stocks.

I think it's unwise to get out of the stock market, or the bond market, even though the economy is uncertain. The market is often stupid, but you can't focus on that. Focus on the underlying value of dividends and earnings.

Invest as efficiently as you can, using low-cost funds that can be bought and held for a lifetime. Don't go chasing past performance, but buy broad stock index and bond index funds, with your bond percentage roughly equaling your age.

Most of all, you have to be disciplined and you have to save, even if you hate our current financial system. Because if you don't save, then you're guaranteed to end up with nothing.

http://www.reuters.com/article/2012/09/11/us-column-taylor-bogle-idUSBRE88A0LI20120911

Here's an excerpt:

Really, what business does the stock market have setting

multiyear highs right now? The U.S. economy grew at an anemic 1.7

percent in the second quarter. It’s creating 139,000 jobs a month

on average this year; that is only a fraction of the monthly hires

needed to bring the unemployment rate back to pre-crisis levels by 2015.

The uncertainty of a close presidential election looms, and no one

knows whether Congress and the president will reach an agreement to

avert the so-called fiscal cliff—the spending cuts and tax hikes that could stall the economy next year. Europe’s financial crisis remains unresolved.

http://www.businessweek.com/articles/2012-09-11/how-did-stocks-get-so-high

Even though I remain bullish on stocks, and believe the broader market averages will be higher by the end of this year, I must confess that I am becoming a little uneasy with the rising bullish sentiment.

Strong market runs rarely start when sentiment skews positive, as it is currently. Random Glenings fave Ned Davis noted this morning that his firm's Crowd Sentiment Poll shows 68% of active managers surveyed are bullish on the prospects for the market, which is towards the higher end of historic averages.

In addition, Mr. Davis points out:

It seems to me that conventional wisdom on Wall Street is that while earnings estimates are being cut a little, still profits are coming in better than expected, and growth should continue. It is true that total corporate earnings have risen this year, but when one looks at the median stock, earnings have actually been flat this year...

...the median P/E ratio of the S&P 500 stocks was 17.6 at the end of August. That means half of the 500 stocks had higher P/Es, and half had lower. A P/E of 17.6 is not that excessive, but it is not cheap, either. Fair value is 1313 on the S&P 500.

http://www.ndr.com/scrndr/servlet/EProduct/BPK006/HOT201209121.PDF?id=159192

So what should you do?

If history is any guide, you probably should do nothing.

More money - both real and opportunistic - has been lost by trying to time the market. The longer run prospects for the stock market remains positive, especially compared to the alternatives, so if your overall asset allocation is comfortable you probably should just go outside and enjoy the beautiful fall weather.

Here's an excerpt from a recent Reuters interview with Vanguard founder John Bogle that offers some perspective (I added the emphasis):

Q: Any advice for people about where they should invest going forward?

A: Stock returns basically come down to dividend yield plus earnings growth. If you have a dividend yield of 2 percent, plus earnings growth of 5 percent, I think a 7 percent annual gain is a rational expectation for stocks.

I think it's unwise to get out of the stock market, or the bond market, even though the economy is uncertain. The market is often stupid, but you can't focus on that. Focus on the underlying value of dividends and earnings.

Invest as efficiently as you can, using low-cost funds that can be bought and held for a lifetime. Don't go chasing past performance, but buy broad stock index and bond index funds, with your bond percentage roughly equaling your age.

Most of all, you have to be disciplined and you have to save, even if you hate our current financial system. Because if you don't save, then you're guaranteed to end up with nothing.

http://www.reuters.com/article/2012/09/11/us-column-taylor-bogle-idUSBRE88A0LI20120911

Subscribe to:

Comments (Atom)