When talking about the current economic picture, most analysts assume that the balance sheet of Corporate America is in pretty good shape, with roughly $1.8 trillion in cash reserves. The debt problems seem to be confined to the government and consumer sectors.

Indeed, a number of columnists have written that it is outrageous that corporations are not spending their cash more aggressive, especially when it comes to new job creation.

However, as this recent article from MarketWatch (reprinted in Yahoo Finance), perhaps corporations are actually much more leveraged than generally believed.

According to this view, much of the corporate cash hoard is actually the result of massive borrowing done by corporate treasurers who are fearful that the money markets will freeze up again a la the fall of 2008.

In addition, a large chunk of corporate cash is being held overseas, which means that it cannot be repatriated back to the U.S. without incurring significant tax penalty.

I had the chance to speak to one of our bond managers here at the bank. She said that she had been struck by the fact that so many of the recent corporate bond deals apparently had no other purpose other than corporate treasurers raising funds at historically low interest rates. Once the bonds have been issued, she noted, many of the borrowers seem to have just moved the funds into Treasury bills.

In other words, anecdotal evidence suggests that perhaps corporations are not as flush as it would appear.

Here's an excerpt from the article:

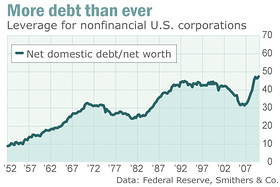

According to the Federal Reserve, nonfinancial firms borrowed another $289 billion in the first quarter, taking their total domestic debts to $7.2 trillion, the highest level ever. That's up by $1.1 trillion since the first quarter of 2007; it's twice the level seen in the late 1990s.

The debt repayments made during the financial crisis were brief and minimal: tiny amounts, totaling about $100 billion, in the second and fourth quarters of 2009.

Remember that these are the debts for the nonfinancials — the part of the economy that's supposed to be in better shape. The banks? Everybody knows half of them are the walking dead.

Central bank and Commerce Department data reveal that gross domestic debts of nonfinancial corporations now amount to 50% of GDP. That's a postwar record. In 1945, it was just 20%. Even at the credit-bubble peaks in the late 1980s and 2005-06, it was only around 45%.

Wonder if the Fed is worried about corporations now too?the-biggest-lie-about-us- companies: Personal Finance News from Yahoo! Finance

No comments:

Post a Comment