|

| Source: The Reformed Broker |

The title of today's post is taken from a quote generally attributed to Niels Bohr, a Danish physicist who was among the pioneers in quantum mechanics.

However, it is also very apt in regards to most things in life. It seems almost human nature that we all try to forecast events, despite the dismal track record of most predictions.

Josh Brown of the blog The Reformed Broker has a good link this morning to a site that I had never visited before, but I plan to bookmarking for future reference.

Titled "Pundit Tracker", the site keeps track of past predictions, and compares them to actual events. As you might expect, the score card is not pretty.

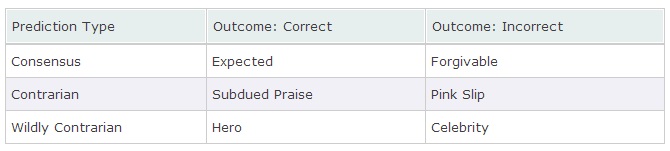

Brown has an excellent table summarizing the whole punditry business, reproduced above. It does a very good job of summarizing the (career) risk/reward of making predictions.

Being in the consensus, but wrong, is usually not job-threatening ("Who would have known?") but bucking the trend and being wrong is often a one-way ticket to the unemployment line ("It was so obvious!").

After noting how wildly wrong most Wall Street forecasts have been for the S&P 500 over the past few years, here's what Josh Brown writes:

The mean S&P estimate was considerably off-target each year: by +960 basis points in 2011, -700 basis points in 2012, and -960 basis points so far this year... the clustering effect was very pronounced, with five of the six analyst predictions each year falling within a 100 point range (1350-1450 in 2010, 1250-1350 in 2011, and 1500-1600 in 2012) – ranges which failed to capture the actual result in every instance.

So what is behind the errant clustering? The biases of anchoring and recency are likely culprits, with analysts anchoring to a baseline...and extrapolating from recent trends. We believe career risk is also at play: as investor Joel Greenblatt put it, “It’s much safer to be wrong in a crowd than to risk being the only one to misread a situation that everyone else had pegged correctly.”

But how do we reconcile the incentive for pundits to not stray from the consensus – and thus minimize career risk – with the bombastic pundits that we all love to rail on? ...Why aren’t they concerned about career risk? Well, here’s the catch:

In punditry, if you are going to be wrong, it pays to be spectacularly wrong.

http://www.thereformedbroker.com/2013/07/24/if-you-are-going-to-be-wrong-it-pays-to-be-spectacularly-wrong/

No comments:

Post a Comment