The S&P 500 posted one of its strongest quarterly gains in recent years to start 2013, returning +10.6% for the first quarter.

The S&P 500 posted one of its strongest quarterly gains in recent years to start 2013, returning +10.6% for the first quarter.However, according to Merrill Lynch, only 35% of all mutual funds outperformed in the quarter. Growth managers in particular have struggled this year, with only 19% of growth funds outperforming the relevant benchmark.

The numbers longer term are not much better for active managers. Merrill indicates that only 31% of all funds have outperformed over the past 12 months, and just 9% of growth managers have managed to beat their indices.

What's going on here?

Turns out the nature of the first quarter rally reflects the general ambivalence about investing in stocks that has characterized the investor mood in recent months.

Normally when markets rally, the market leaders are the more volatile sectors like technology and industrials.

But not this year.

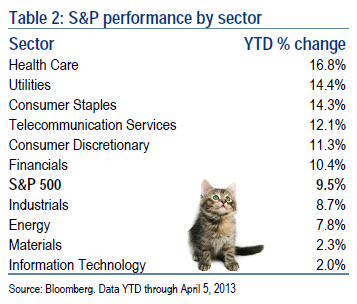

Here, courtesy of Merrill Lynch (as reprinted in the FT's blog Alphaville) is a summary of how each sector performed so far this year (the cat is also included in Merrill's report).

Technology is the largest weight in the S&P at 17.5%.

The poor performance of Apple so far this year (-25%) has been a major reason that tech returns have suffered. Apple continues to be widely held by both growth and value managers since its financial metrics are so attractive to both equity styles, but clearly its relentless move lower has hurt returns.

On an historic basis, the groups dominating performance this year are at trading at lofty valuations levels which would seem to make them vulnerable to corrections.

Health and Personal Care (HPC) analyst Wendy Nicholson at Citigroup, for example, wrote a piece dated April 10, 2013, that noted the following:

The HPC group is trading at an average of 18x our CY14 EPS estimate, or nearly a 30% premium to the market multiple. This compares to an average relative premium of 10% over the last 15 years or so.While we appreciate the market's enthusiasm for a stronger outlook for underlying EPS growth for the HPC companies in 2013....we still believe that the long-term future EPS growth for the group will remain at levels well below that which we have seen at times historically.

In other words, the typical manager is struggling with the dilemma of "chasing what's working" and ignore valuation, or stay with what has worked in the past, and face the possibility of several more months of returns that lag the benchmark.

No comments:

Post a Comment