Energy stocks - those companies focused on various sectors of the oil and natural gas industry - have been relatively poor performers over the past year, as the chart above indicates.

To try to understand what is going on with the group, I went to hear Bill Featherson of UBS Investment Research last week.

Bill has been following the group for nearly 20 years, and is one of the better analysts in the space. He's been through a number of cycles with his companies, and has a good sense of what is going on in the industry from both a quantitative and qualitative perspective.

For the most part, the stocks in the energy group are selling at levels that are at the lower end of their historic valuation levels. The big integrated oil companies - ExxonMobil, Chevron, and the like - in particular stand out as very attractive values, with most P/E's in the single digits and very attractive dividend yields.

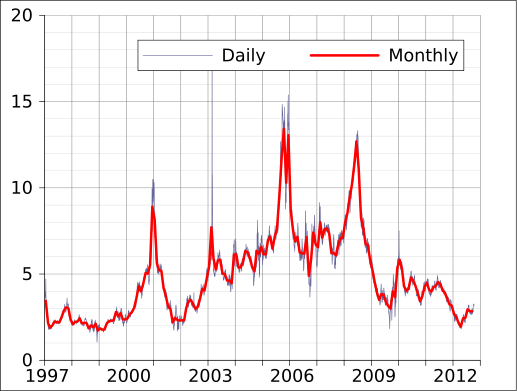

Problem is, said Bill, is that the group suffers from a combination of excess supply and only weak demand. The natural gas market in particular is awash in inventory, making it difficult for natural gas suppliers like Exxon and Devon to earn attractive rates of return:

|

| Natural Gas Prices Remain at Low Levels (source: Wikipedia) |

The situation is not likely to improve in 2013, according to Bill, particularly when it comes to natural gas. New drilling techniques - most notably fracking - have allowed vast reservoirs of natural gas to be drilled throughout the United States, allowing our country to head towards energy independence. While this is obviously good news for consumers, it makes it difficult to find any near-term stock catalysts for the stocks operating in the space.

Bill thinks that the energy stocks will trade mostly in a range for the foreseeable future, with limited opportunities for sustainable profitable trades.

He compares the current period to the 1990's, when the best strategy for investing in the energy stocks was to buy them when oil and gas prices moved lower, then sell the stocks whenever a short-term spike in prices jumped. In his opinion, oil prices will remain in the $90 per barrel area for the next couple of years, and natural gas in the $3.50 btu vicinity.

No comments:

Post a Comment