Worried about the economy, but needing income, investors have flocked to stable, high dividend paying sectors like telecom and utilities, and prices have risen accordingly.

For example, for the 6 months ending September 30, the prices of telecom stocks have soared by more than +20%, while the S&P 500 has risen just slightly more than +2%.

But is the rally in high dividend paying stocks overdone?

Joseph Paul, chief investment officer at AllianceBernstein, thinks that there is a bubble in high yield stocks, and has written an excellent blog post presenting his data.

Here's an excerpt from what he wrote last week (I added the emphasis):

...High-yield stocks are as pricey as they’ve been since the early 1950s, trading at a modest premium to the market versus a long-term average discount of 20%. We don’t view this premium as exorbitant given the current market anxieties, but it does limit upside potential and makes these stocks more vulnerable than others if sentiment turns. Most of the high-priced dividend-paying stocks are in mature, slow-growth sectors such as consumer staples, telecom and utilities, which are likely to look less appealing than more economically sensitive stocks in a sustained economic recovery.

http://blog.alliancebernstein.com/index.php/2012/10/17/are-high-yield-stocks-in-bubble-territory/?utm_source=rss&utm_medium=rss&utm_campaign=are-high-yield-stocks-in-bubble-territory

Mr. Paul goes on to present a couple of charts that indicate just how much high yield stocks have outperformed the market, noting that as a percentage of the total market value high yield stocks have not been this high since the early 1980's:

And while he is not necessarily suggesting exiting high dividend payers, he does note that historically the group has been very vulnerable to higher interest rates:

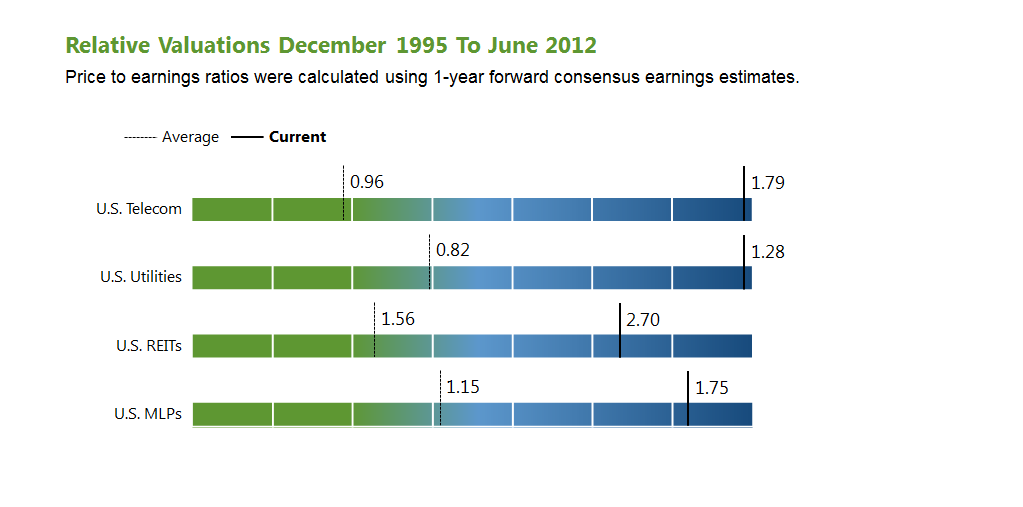

The managers of high yield stocks at investment giant Pimco were making the rounds recently, and showed a chart indicating just how highly valued the telecom and utility sectors are relative to historic averages:

Throw on top of all of this valuation work is the very real possibility that tax rates on dividend stocks could rise significantly.

If Congress does not act before year-end, the tax rate for those in the highest income bracket will reach 43.4%, compared to just 15% currently. While it is true that more than half of dividend-payers are in tax deferred accounts, it still leaves a very large segment of the market vulnerable to higher tax rates, if that comes to pass.

Wheeler Real Estate Investment (NASDAQ: WHLR) today declared a dividend of $0.0350 per share payable on February 28, 2013 to shareholders of record as of February 01, 2013. Dividend amount recorded is decrease of $0.014 from last dividend Paid.

ReplyDeleteBest Dividend Stocks