Lots going on today.

The nuclear situation in Japan apparently getting worse (if that's possible). Saudi Arabia has sent troops into Bahrain.

And, as I write this note, the 10-year Treasury is trading at 3.17%, while the stock market is taking it on the chin.

The strong rally in the bond market has been anticipated by faithful readers of Random Glenings. Interest rates have declined more than 50 basis points from their recent peak in early February 2011, defying the overwhelming consensus that that rates are poised to move higher.

Ah, not so fast, I can hear you say. Aren't rates are moving lower on Treasurys because of horrible news in Japan? And isn't it more likely that investors are only buying Treasurys in a "flight to safety" mode, and will quickly dump bonds once some the overseas situations calm down?

Well, maybe. But maybe we're in an old-fashioned Keynesian liquidity trap, where no amount of monetary stimulus "moves the needle" when it comes to the economy.

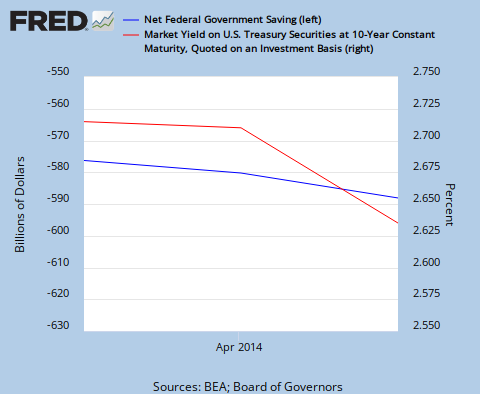

Here's an excerpt from Paul Krugman's blog via the New York Times. After noting that interest rates continue to fall despite huge federal deficits, he presents the following:

If you had told most people, back in 2007, that the federal government would soon be running budget deficits in the vicinity of 10 percent of GDP, most of them would have predicted soaring interest rates. In fact, quite a few people did predict just that — and in some cases lost a lot of money for their investors.

But it hasn’t happened. Short rates have stayed near zero; long rates have fluctuated with changing views about the prospects for recovery, but stayed consistently below historical norms. That’s exactly what those of us who understood liquidity-trap economics predicted, right from the beginning.

Yes, We're In A Liquidity Trap - NYTimes.com

No comments:

Post a Comment